In today’s hyper-connected world, smartphones are no longer just communication devices—they are essential tools for work, entertainment, banking, shopping, and even identity verification. With the rising cost of premium devices like the iPhone, Samsung Galaxy, and others, losing or damaging a phone can feel like a major financial setback. This is where phone insurance in Pakistan is gaining momentum. But as with any rapidly emerging service, consumers often wonder: What’s the catch?

The Growing Demand for Phone Insurance in Pakistan

Pakistan’s smartphone market has expanded significantly in recent years. With over 190 million mobile phone users and a booming second-hand phone market, the demand for mobile phone protection plans has never been higher. As smartphones get smarter and pricier, the risks associated with theft, screen damage, or internal hardware failure increase too.

Brands like InstaCare, TPL Insurance, EFU, and Pak-Qatar Takaful now offer various forms of mobile phone insurance in Pakistan, including accidental damage, theft, liquid damage, and extended warranty services.

But while this all sounds promising, let’s break down the benefits—and potential pitfalls—of phone insurance in the Pakistani market.

What Does Phone Insurance Typically Cover?

Most reputable phone insurance providers in Pakistan offer coverage for:

- Accidental damage (screen cracks, drops)

- Water or liquid damage

- Theft or robbery

- Device replacement or repair services

- Extended warranty after the manufacturer’s warranty expires

Some companies offer flexible monthly or annual plans. Others require a one-time premium based on the phone’s model and purchase value.

However, not all insurance policies are created equal. Always check the fine print.

The Hidden Terms and Conditions (The Catch)

Here’s what many customers fail to notice before signing up:

- Depreciation Clauses: Insurance companies often don’t reimburse the full value of your phone. A depreciation value is applied, meaning the longer you’ve owned your phone, the less you’re reimbursed.

- Excess Charges: In some cases, you’re required to pay an “excess fee” or deductible when filing a claim. This could range from Rs. 1,000 to Rs. 10,000 depending on your policy.

- Limited Repair Options: Some insurers only allow repairs at specific authorized service centers. If you’re in a smaller city or town, you might have limited access to such facilities.

- Delayed Claims Process: Users often complain about the slow processing of claims. Approvals can take weeks, and documentation requirements can be extensive.

- Exclusions in Coverage: Many policies do not cover intentional damage, software issues, unreported theft, or unauthorized repairs.

- IMEI Lock and PTA Registration: For imported or unregistered phones, insurers may refuse to cover damages or theft. The phone must be PTA-approved and registered in the buyer’s name.

Is It Worth Getting Phone Insurance in Pakistan?

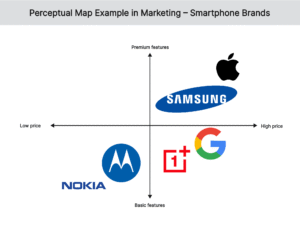

For high-end phone users (iPhone, Samsung S-series, OnePlus, etc.), insurance is worth considering. If you’re spending over Rs. 200,000 on a phone, paying a few thousand annually for protection makes sense—provided the insurance company is credible.

Mid-range or budget phone users, however, might not find it cost-effective. In many cases, the repair or replacement cost is lower than the combined insurance premium and excess fee.

How to Choose the Right Phone Insurance Provider

Here’s a checklist to help you make the right choice:

- Compare multiple providers: Use online comparison tools or reach out to customer service for detailed information.

- Read customer reviews: Real feedback can expose red flags like denied claims or delays.

- Ask about claim process: Is it online, how long does it take, what documents are required?

- Verify approved service centers: Make sure you can access one nearby.

- Double-check coverage: Theft, screen damage, battery issues, etc.

Some well-known options in Pakistan include:

- TPL Insurance – TPL Device Protection

- InstaCare Phone Insurance

- EFU Life Gadget Insurance

- Jubilee General Insurance

- Ufone Handset Protection Plans (for their own customers)

Alternatives to Phone Insurance

If you’re skeptical about insurance, consider these practical alternatives:

- Use a strong phone case and screen protector

- Install anti-theft apps and tracking tools

- Back up your phone regularly

- Save an emergency repair fund

- Use secure lockers or insured bags during travel

Final Thoughts

Phone insurance in Pakistan is still a developing sector. While it offers value, it also comes with fine print that every buyer should understand. The key is to do thorough research, evaluate your risk, and decide whether the monthly or annual cost makes financial sense based on your phone’s value and your usage style.

In short, phone insurance can save you money—but only if you know exactly what you’re signing up for.

#PhoneInsurancePakistan #SmartphoneCoverage #MobileProtectionPlan #TPLInsurance #InstaCareInsurance #MobileRepairCoverage #PTAApprovedPhones #PakistanTechCare #PhoneDamageProtection #SecureYourDevice